Valuing your estate

Arriving at the amount of Inheritance Tax payable

To arrive at the amount of Inheritance Tax potentially payable when valuing your estate, you need to include assets (property, possessions, investments and money) you own and certain assets you have given away during the last seven years. The valuation must accurately reflect what those assets would reasonably receive in the current open market.

The valuation process

This involves taking the value of all the assets owned together with the value of:

your share of any assets that are owned jointly with someone else

any assets that are held in a trust, from which you have the right to benefit

any assets which you have given away, but in which you kept an interest – for instance, if you gave a house to your children but still lived in it rent-free

certain assets that you given away within the last seven years

Next, from the total value above, deduct everything that is owed, for example:

any outstanding mortgages or other loans

unpaid bills

The value of all the assets, less the deductible debts, gives you the estate value. The threshold above which the value of estates is taxed at 40 per cent is currently £325,000 (frozen until April 2019).

Married couples (or registered civil partners) can add up their combined estates and reduce this by two allowances of £325,000 before applying the 40% rate to estimate their potential Inheritance Tax liability.

This is based on our understanding of current tax legislation. Whether any tax will be payable, at what level it is charged and whether you qualify for tax relief will depend upon individual circumstances and may be subject to change in the future.

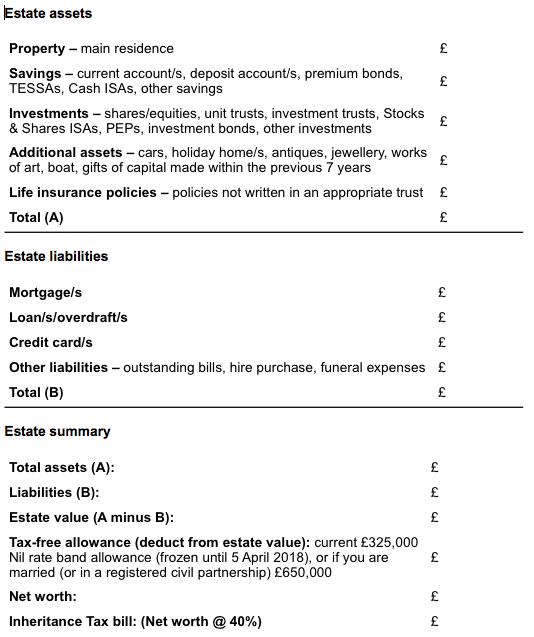

Inheritance Tax Calculator

To estimate how much Inheritance Tax you may have to pay, add up the value of all your wealth, subtract your liabilities and the £325,000 nil rate band allowance, and then multiply the remainder by 40%.

If you are married or in a registered civil partnership, add up your combined estates and reduce these by two nil rate band allowances of £325,000 each (£650,000) before applying the 40% rate to estimate your potential liability to Inheritance Tax.

Married couples and civil partners are allowed to pass their possessions and assets to each other tax-free and, since October 2007, the surviving partner is now allowed to use both tax-free allowances (providing one wasn’t used at the first death).

Gifts made within the last seven years are not included in the calculations but may be liable to IHT on a sliding scale.

Estate values are for your general information and use only and are not intended to address your particular requirements, and should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation.

Investment advice will be provided by our sister company ad+ Financial.

The value of your investments can go down as well as up and you may get back less than you invested.

The Financial Conduct Authority does not regulate Tax Advice, Trusts, Cash ISAs and National Savings and Investments.

Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor.

Content of the articles featured is for general information and use only and is not intended to address an individual or company’s particular requirements or be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles.

Comments (0)