Our core values are the soul, passion, and lifeblood of our businessRead all about them.

Read some real life stories from our clients.

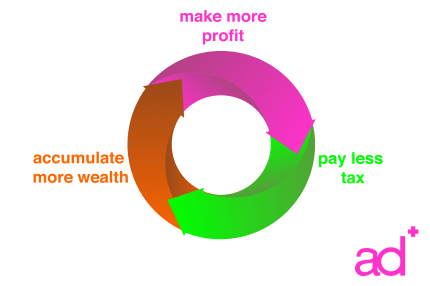

We’re an outcome-focused Glasgow accountant firm. This means that when you work with us, you get what you want out of life and business. Guaranteed

Although the ad+ team has advised business owners in many sectors the common strand running throughout the client base is ambition and a desire to improve. ad+ helps clients fulfil their ambitions via a regular series of goals setting, planning, and implementation review discussions.

Whether your business operates in construction, recruitment, hospitality, or retail

ad+ welcomes the opportunity to help you improve your business results

and thereby achieve high goals you have for yourself and your family.

Your Wealth

Growing Rapidly

Raising Capital

securing vital capital

Managing Finances

cash flow management

Getting Grants

unique funding sources

Business One Page Plan

crystal-clear, plain English plan

Reducing Your Tax

Tax Strategies

planning for the future

High value investments*

advising you for the greatest return

Strategic management accounts

what’s coming and how to address it

Tax Avoidance

avoid paying higher rate tax

Protecting Your Wealth

Personal tax planning

minimise personal tax liability

Investment management

large or diverse investment portfolio?

Growth Consultancy

ongoing asset value

Retirement planning*

exit and succession planning

Get our Tip of the Week

These business tips identify a few simple things you can do to make your life, and your business, better. Thoughts on marketing, and grants, and taxes, and employees ….you get the idea.

OUR PROMISE TO

OUR PROMISE TO